ADP pay rate is a critical aspect of employee compensation, impacting financial planning and job satisfaction. This report delves into understanding your ADP pay rate, from accessing pay stubs and W-2s to deciphering pay components and troubleshooting potential discrepancies. We’ll explore how to interpret your net pay, compare rates across industries, and utilize ADP data for financial analysis.

Navigating the ADP system effectively requires understanding its various features. This guide provides a comprehensive overview of how to access your pay information, calculate net pay from gross pay, and identify resources for resolving any discrepancies or questions you may have. We also discuss the impact of taxes, deductions, and benefits on your overall compensation.

ADP Pay Rate Information Sources

Accessing accurate and timely information regarding your ADP pay rate is crucial for financial planning and ensuring accurate compensation. This section details various methods to obtain this information and resolve any discrepancies.

ADP pay rate discrepancies are a common concern for employees. Workers often seek supplemental income, leading some to explore avenues like those found on lansing craigslist for sale , to supplement their earnings. Understanding your ADP pay rate is crucial for budgeting and financial planning, regardless of any additional income streams.

Accessing Pay Stubs and W-2s Through the ADP Portal

The primary source for ADP pay rate information is the ADP employee self-service portal. Employees can typically log in using their provided credentials to access their pay stubs, which detail gross pay, net pay, deductions, and other relevant compensation components for each pay period. W-2 forms, summarizing annual earnings and tax withholdings, are also usually accessible through this portal, typically available after the tax year ends.

Viewing Pay Rate History Within ADP

Most ADP systems allow employees to review their pay rate history. This feature usually provides a chronological record of pay rates, highlighting any changes over time. The specific method for accessing this history varies depending on the employer’s ADP configuration, but it’s often found within the pay stub or earnings history section of the portal.

Contacting ADP Support for Pay Rate Discrepancies

If discrepancies arise between expected and received pay, contacting ADP support is essential. Their contact information, including phone numbers and online support channels, is usually available on the ADP employee portal or your employer’s intranet. Clearly articulate the discrepancy, including pay period dates, expected pay, and actual pay received, to facilitate efficient resolution.

Understanding ADP Pay Rate Components

Understanding the components that constitute your total pay is vital for comprehending your earnings. This section breaks down the various elements influencing your ADP pay rate.

Components of Total Pay Rate

An employee’s total pay rate typically includes several components: base pay (the standard hourly or salary rate), bonuses (performance-based or other supplemental payments), overtime pay (for hours worked exceeding standard limits), and any other additional compensation such as commissions or allowances. These elements are clearly displayed on ADP pay stubs.

Impact of Taxes and Deductions on Net Pay, Adp pay rate

Taxes (federal, state, local) and various deductions (health insurance premiums, retirement plan contributions, etc.) are subtracted from gross pay to arrive at net pay, the amount actually received. ADP clearly shows both gross and net pay, along with a detailed breakdown of all deductions and taxes withheld.

Calculating Net Pay from Gross Pay

Source: quoracdn.net

Net pay can be calculated by subtracting all taxes and deductions from the gross pay. This calculation can be easily verified using the detailed breakdown provided on the ADP pay stub. For example: If gross pay is $2000, and total deductions are $400, then net pay is $1600. This simple calculation helps employees confirm the accuracy of their ADP-reported net pay.

Comparing ADP Pay Rates Across Industries and Roles

Comparing pay rates across industries and roles provides valuable context for evaluating compensation. This section provides methods for conducting such comparisons.

Average ADP Pay Rates Across Industries

Gathering precise average ADP pay rates across various industries and roles requires access to extensive, aggregated payroll data, which is typically not publicly available due to privacy concerns. However, general salary data from reputable sources like the Bureau of Labor Statistics (BLS) or industry-specific salary surveys can offer valuable comparative benchmarks.

| Industry | Role | Average Pay Rate (Example) | Data Source |

|---|---|---|---|

| Technology | Software Engineer | $110,000 | BLS |

| Healthcare | Registered Nurse | $75,000 | BLS |

| Finance | Financial Analyst | $85,000 | BLS |

Factors Influencing Pay Rate Variations

Several factors influence pay rate variations within the same industry, including experience level, education, skills, location, company size, and performance. For example, a senior software engineer with a master’s degree will typically command a higher salary than a junior engineer with a bachelor’s degree, even within the same company.

Resources for Researching Industry-Standard Salary Ranges

Reliable sources for researching industry-standard salary ranges include the Bureau of Labor Statistics (BLS), Glassdoor, Salary.com, and Payscale. These resources provide salary data based on various factors, allowing for more nuanced comparisons with ADP-reported pay rates.

Troubleshooting ADP Pay Rate Issues

Despite the accuracy of ADP systems, occasional discrepancies can occur. This section Artikels common problems and their resolutions.

Common Pay Rate Problems and Solutions

Common issues include incorrect hours reported, errors in pay rate calculations, missing bonuses, or discrepancies in tax withholdings. Addressing these requires careful review of pay stubs, contacting the payroll department for clarification, and possibly submitting a formal pay correction request.

Step-by-Step Guide to Resolving Discrepancies

- Review your pay stub thoroughly for any errors.

- Compare your ADP pay with your employment contract or offer letter.

- Contact your payroll department or HR to inquire about any discrepancies.

- Provide all relevant information, such as pay period dates and details of the discrepancy.

- Follow the company’s established procedure for reporting and resolving pay errors.

Flowchart for Reporting and Resolving ADP Pay Rate Errors

A flowchart would visually depict the steps involved in reporting and resolving pay rate errors, starting with identifying the discrepancy, then contacting the appropriate personnel, submitting documentation, and finally receiving confirmation of the correction. Each step would be represented by a box, with arrows indicating the flow of the process. The final box would represent resolution and confirmation.

Examples of Pay Rate Inquiries and Solutions

Example 1: An employee notices a discrepancy in their overtime pay. Solution: They contact payroll, providing details of the overtime hours worked and comparing it to the ADP record. Example 2: An employee’s bonus is missing from their pay. Solution: They check their employment agreement and contact HR to inquire about the status of the bonus payment.

ADP Pay Rate and Employee Benefits

Employee benefits are often integrated with ADP payroll systems, influencing net pay. Understanding this relationship is crucial for financial planning.

Relationship Between ADP Pay Rate and Employee Benefits

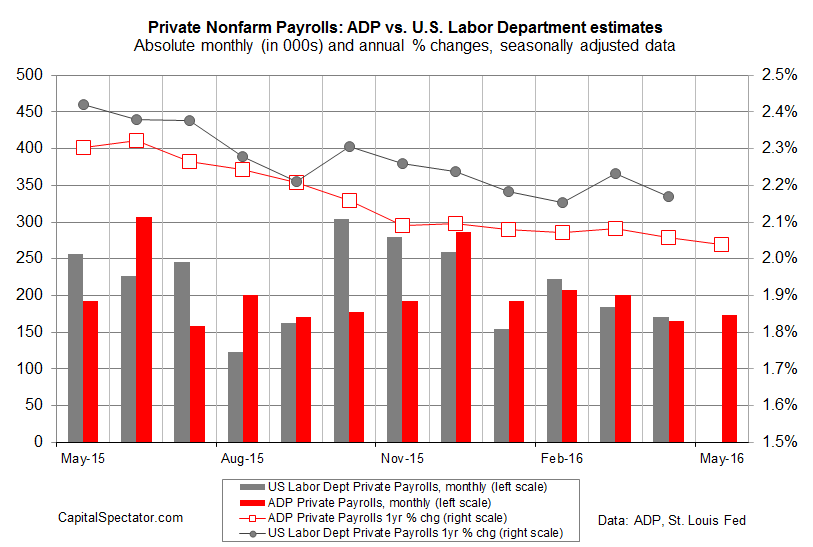

Source: capitalspectator.com

Employee benefits, such as health insurance, retirement plans, and paid time off, are often deducted from gross pay, directly impacting the net pay displayed in ADP. The cost of these benefits is either fully or partially covered by the employer and/or employee, with the employee’s contribution deducted from their paycheck.

Impact of Benefit Deductions on Net Pay

Various benefit deductions, such as health insurance premiums, 401(k) contributions, and other pre-tax or post-tax deductions, directly reduce an employee’s net pay. ADP clearly shows these deductions on pay stubs, allowing employees to track their benefit costs.

Common Employee Benefits Integrated with ADP

- Health insurance

- Dental insurance

- Vision insurance

- Life insurance

- Disability insurance

- Retirement plans (401k, pension)

- Paid time off (vacation, sick leave)

Accessing Benefit Information Within ADP

Information about benefit costs, coverage details, and enrollment options is usually accessible through the employee self-service portal within the ADP system. This information is typically found in a dedicated section for benefits, often linked directly from the employee’s pay stub or home page.

Visualizing ADP Pay Rate Data

Visualizing pay rate data helps in identifying trends and patterns over time. This section explains how to create such visualizations.

Creating Visual Representations of Pay Rate Trends

ADP data can be exported to spreadsheet software (like Microsoft Excel or Google Sheets) for creating visual representations of pay rate trends. This allows employees to track their earnings over time, identify any inconsistencies, and plan accordingly.

Creating a Line Graph Showing Pay Rate Changes

A line graph can effectively illustrate changes in pay rate over time. The x-axis would represent time (e.g., pay periods or months), and the y-axis would represent the pay rate. Data points would represent the pay rate for each time period, connected by a line to show the trend. Clear labels and a title are essential for readability.

Creating a Bar Chart Illustrating Pay Components

A bar chart can visually represent the breakdown of pay components for a given pay period. Each bar would represent a component (base pay, bonuses, taxes, deductions), with the height of the bar corresponding to its monetary value. Clear labels for each bar and a title are crucial for understanding the chart.

Exporting ADP Pay Data for Further Analysis

Most ADP systems allow exporting pay data into common spreadsheet formats (like CSV or Excel). This exported data can then be used in spreadsheet programs or data visualization tools for more detailed analysis and the creation of customized charts and graphs. The specific export options are usually found within the pay stub or earnings history section of the ADP portal.

Last Recap

Mastering your ADP pay rate information empowers you to effectively manage your finances and advocate for your compensation. By understanding the components of your pay, utilizing available resources, and knowing how to address discrepancies, you can ensure accurate and fair compensation. Remember to leverage the tools and resources provided by ADP to maintain a clear picture of your earnings and benefits.